28 Feb 2026

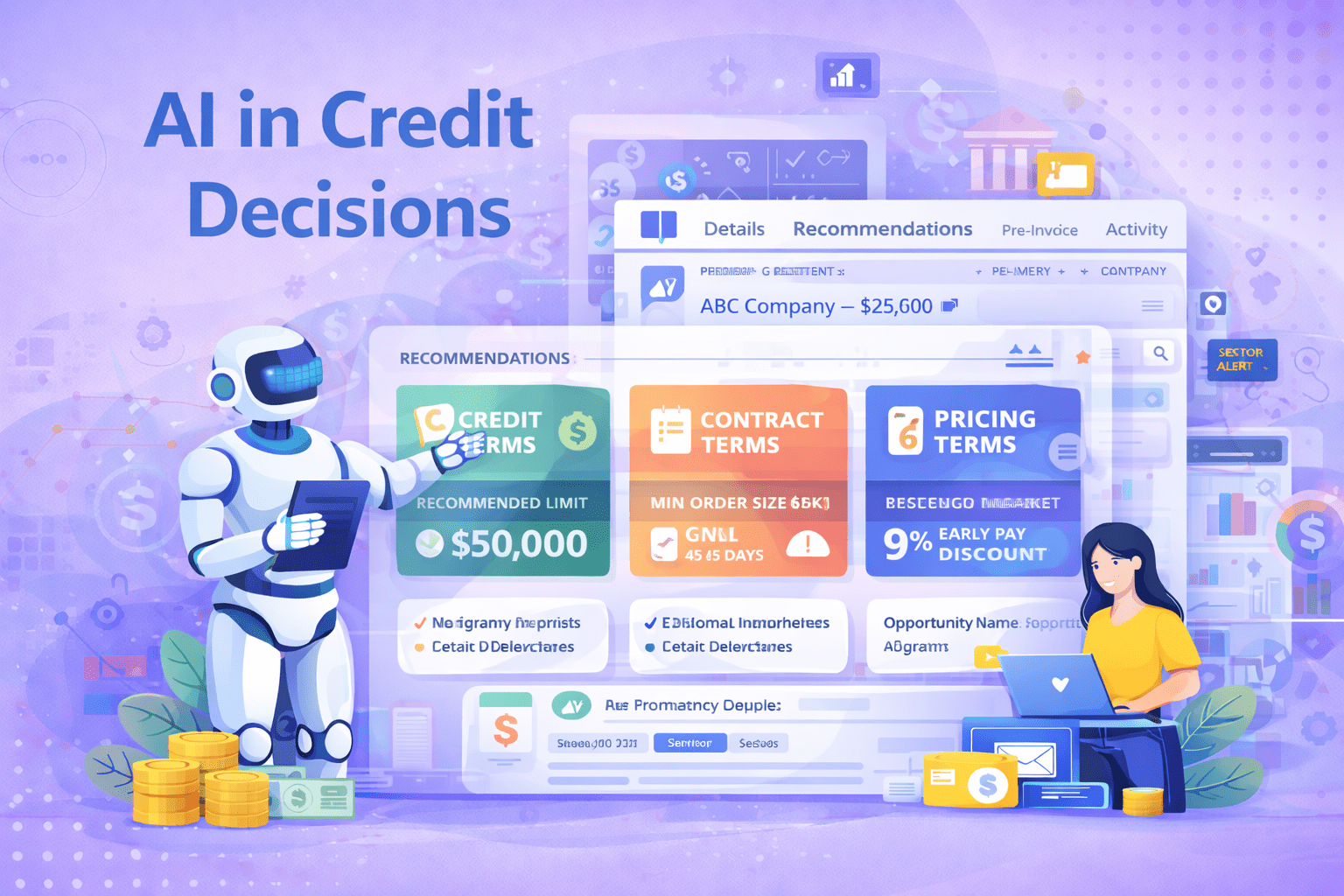

AI in Credit Decisions

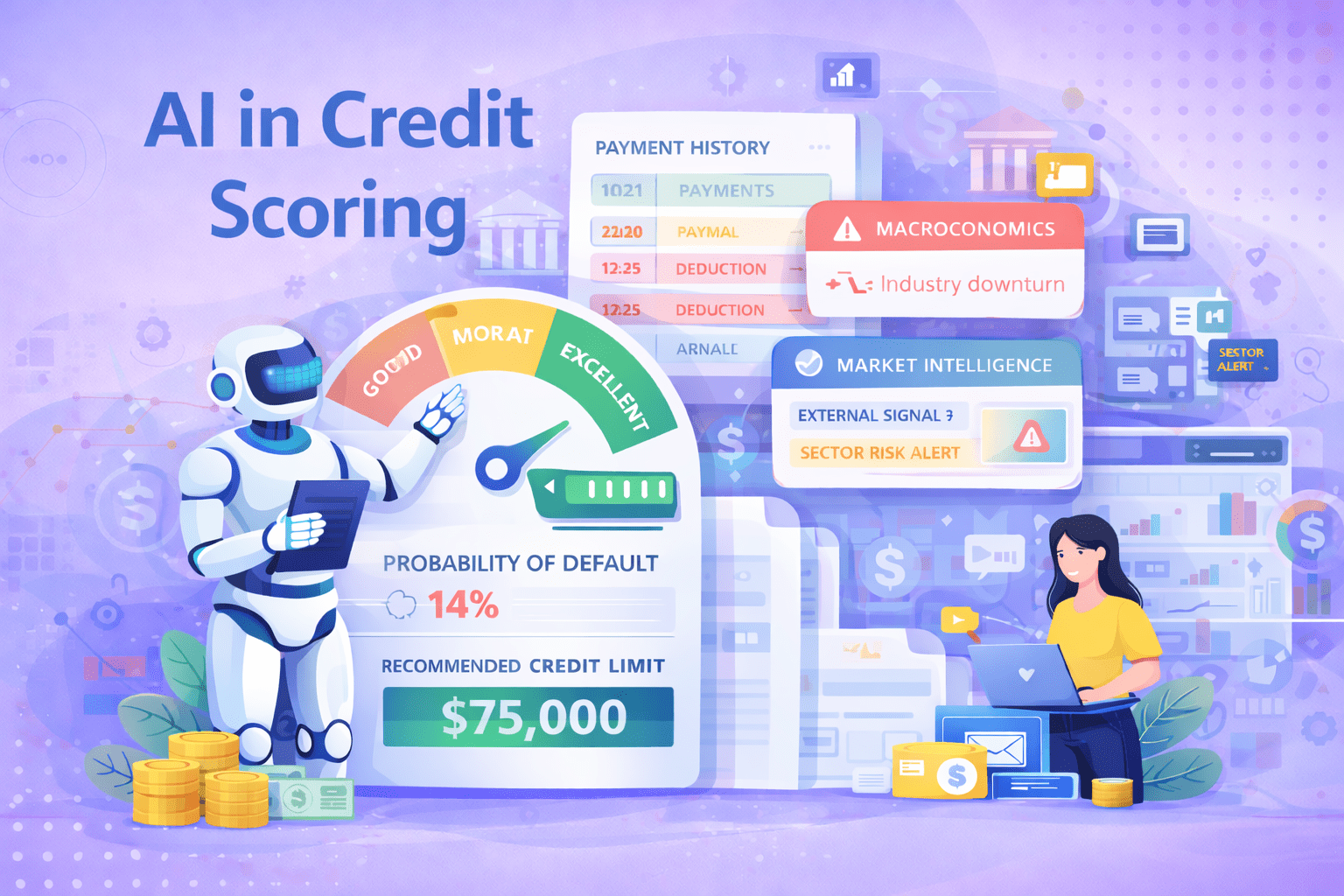

Credit scoring evaluates risk. Credit decisions act on it. While scoring measures probability, decisioning determines: AI in credit decisions transforms these decisions from manual approvals into intelligent, policy-driven actions embedded directly into CRM workflows. Table of Contents What Is AI in Credit Decisioning? AI in credit decisioning uses predictive risk models, workflow automation, and real-time […]

Amartya Singh (CEO, FinFloh)