In today’s fast-paced business world, the advantages of cognitive document processing are redefining how organizations handle data and documents. While bots and OCR tools once drove automation, they struggle with unstructured formats and complex workflows. Cognitive document processing, on the other hand, brings intelligence, adaptability, and speed to financial and operational processes.

Finance teams, in particular, spend countless hours manually entering data, verifying accuracy, and managing exceptions. These inefficiencies slow down critical processes such as order-to-cash, procure-to-pay, and cash application.

While automation tools like OCR and RPA have helped, they often fall short when dealing with the unstructured and unpredictable nature of real-world documents.

Table of Contents

Why Traditional Bots Aren’t Enough?

Companies that recognize the advantages of cognitive document processing gain a measurable edge — reducing manual work while improving speed and accuracy.

Bots and OCR tools are designed for structured data — they work best when documents follow a predictable format. For example, a standard invoice layout can be read easily. But once formats vary or include handwritten notes, mixed languages, or embedded tables, bots quickly lose reliability.

This leads to:

- High maintenance costs due to frequent rule updates

- Increased manual intervention for exception handling

- Limited scalability across geographies and document types

Ultimately, these limitations prevent organizations from achieving true end-to-end automation.

What Makes Cognitive Document Processing Different?

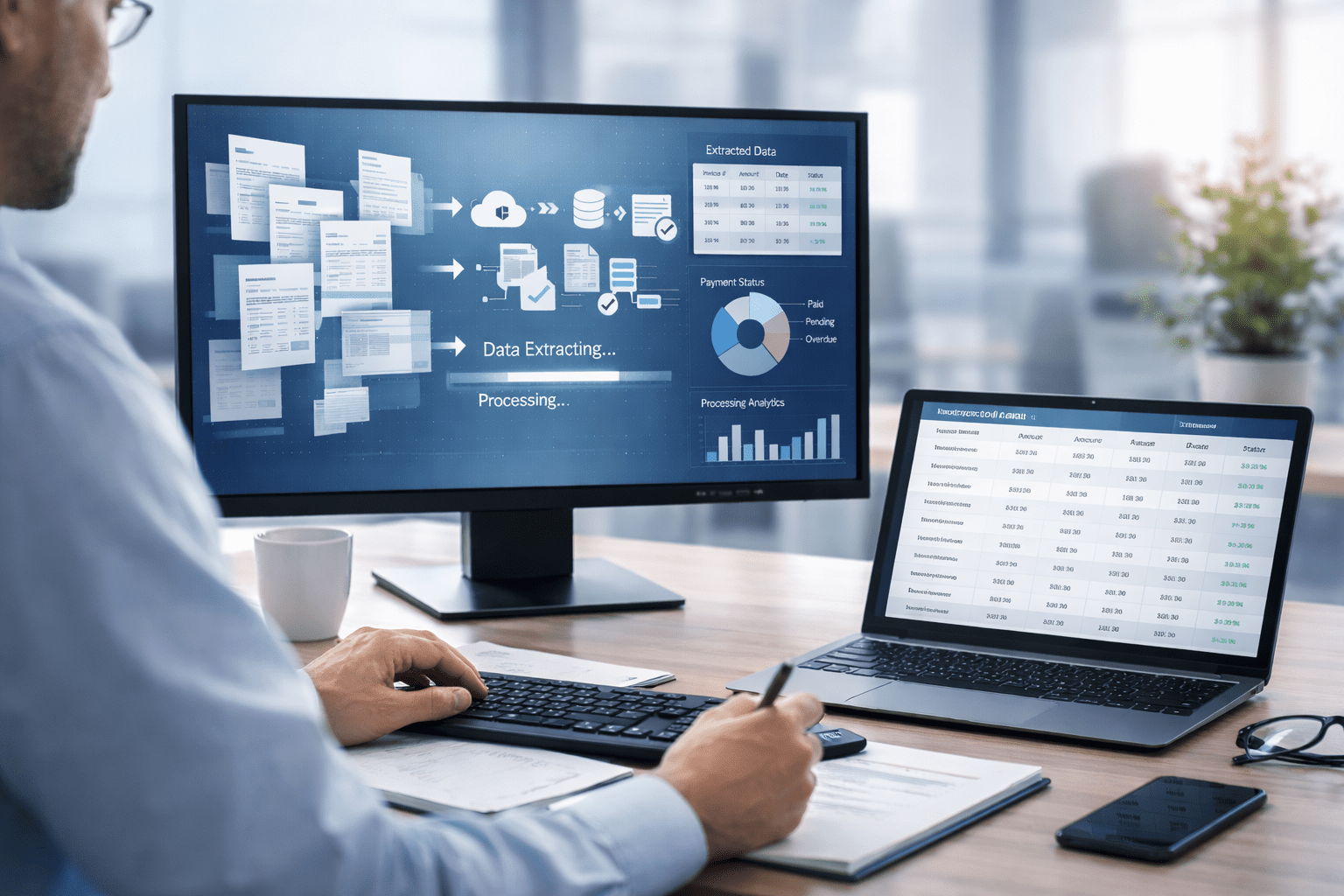

Cognitive Document Processing (CDP) represents a leap forward from simple automation. It combines intelligent data recognition, contextual understanding, and self-learning capabilities to interpret information from both structured and unstructured sources.

Key Capabilities of Cognitive Document Processing

- Intelligent Data Extraction: Captures key fields from invoices, purchase orders, statements, remittances, and more—regardless of layout or format.

- Contextual Understanding: Goes beyond keywords to interpret meaning based on document type and content.

- Self-Learning Improvement: Continuously refines accuracy as it processes more documents.

- Multilingual and Multi-format Support: Handles global document diversity with ease.

Unlike static bots, cognitive document processing grows smarter with every use — reducing human effort and boosting process reliability.

How It Works in Real-World Scenarios?

1. Invoices and Purchase Orders: Real Advantages of Cognitive Document Processings

CDP automatically identifies key details such as invoice number, supplier name, line items, and payment terms — even when the layout changes. This eliminates repetitive manual work and accelerates approvals.

2. Cash Application

In traditional workflows, finance teams depend on bank lockbox services or manually key data from remittances. CDP automatically extracts data from multiple sources — emails, PDFs, Excel files, vendor portals, and EDI transmissions — and matches payments to invoices or purchase orders.

The result?

- Faster reconciliations

- Higher auto-match rates

- Reduced lockbox costs

- Improved visibility into cash flow

3. Compliance and Audit Readiness

By maintaining a digital trail of all extracted and processed data, CDP simplifies audit preparation and ensures regulatory compliance without additional manual documentation.

The Human Advantage: How Cognitive Document Processing Empowers Teams

Cognitive document processing isn’t about replacing people — it’s about enhancing human decision-making. By automating repetitive data-handling tasks, teams can focus on higher-value responsibilities like:

- Strategic planning

- Customer engagement

- Exception handling

- Process optimization

In other words, it’s not about taking humans out of the process — it’s about putting them where they add the most value.

The Broader Business Advantages of Cognitive Document Processing

Adopting cognitive document processing delivers tangible results across financial operations:

- Accelerated Cycle Times: Faster access to clean, structured data enables quicker decision-making.

- Improved Accuracy: Reduced manual errors lead to more reliable financial reporting.

- Cost Efficiency: Minimizes dependency on lockboxes, manual processing, and rule maintenance.

- Scalability: Handles document volume growth without increasing headcount.

Enhanced Customer Experience: Quicker invoice processing and payment handling lead to stronger relationships.

Conclusion: The Future Belongs to the Cognitive Enterprise

Cognitive document processing is more than just an upgrade — it’s a foundation for intelligent, future-ready operations. Organizations that embrace the advantages of cognitive document processing today are positioning themselves for smarter automation, resilient workflows, and stronger financial performance.

At FinFloh, we make this transformation effortless with intelligent automation built for finance. Book a demo or talk to our experts to see it in action.