“Not Sufficient Funds” (NSF) — three words that instantly disrupt your payment cycle.

When a customer’s payment fails due to insufficient funds, it doesn’t just bounce a transaction; it slows down your cash flow, adds operational load, and dents your customer relationship.

For B2B sellers, NSF transactions aren’t rare — they’re routine annoyances that become major pain points when not handled properly. Understanding why NSF occurs and how to manage it efficiently can make all the difference in maintaining a healthy receivables process.

Table of Contents

Understanding Not Sufficient Funds Transactions

An NSF transaction occurs when a customer tries to make a payment — usually via check or ACH — but their account doesn’t have enough money to cover it.

The transaction gets rejected, and the seller receives a notice labeled “NSF” or “Payment Returned.”

Banks charge the customer an NSF fee, and sometimes the business accepting the payment also bears a penalty.

These incidents can quickly pile up, affecting both reputation and cash management.

How Not Sufficient Funds Transactions Work

- The customer initiates a payment.

- The bank verifies if the payer’s account balance can cover the amount.

- If funds are insufficient, the bank rejects the transaction.

- A “return code” is issued (for example, R01 – Insufficient Funds).

- The seller or business must reinitiate collection or request alternate payment.

Without automation, this process can take days — delaying recognition of revenue and follow-up.

Problem Statement: Not Sufficient Funds and Payment Delays

In a world where speed matters, NSF transactions drag you backward.

Finance teams lose time reconciling failed payments. Collections teams chase customers manually. And businesses struggle to forecast cash flow accurately.

Multiply this across hundreds of transactions, and NSF quickly becomes a silent profit killer.

Consequences of NSF Transactions

1. Delayed Cash Flow

Every failed payment pushes collections further out.

2. Added Fees

Both customers and businesses may face NSF or return charges.

3. Damaged Credibility

Repeated NSF issues strain relationships with suppliers and clients.

4. Operational Overhead

Manual retries, reconciliations, and communications waste time.

It’s not just about one failed payment — it’s the ripple effect that follows.

Preventing Not Sufficient Funds Issues

While NSF cannot be completely eliminated, it can be minimized with the right preventive practices:

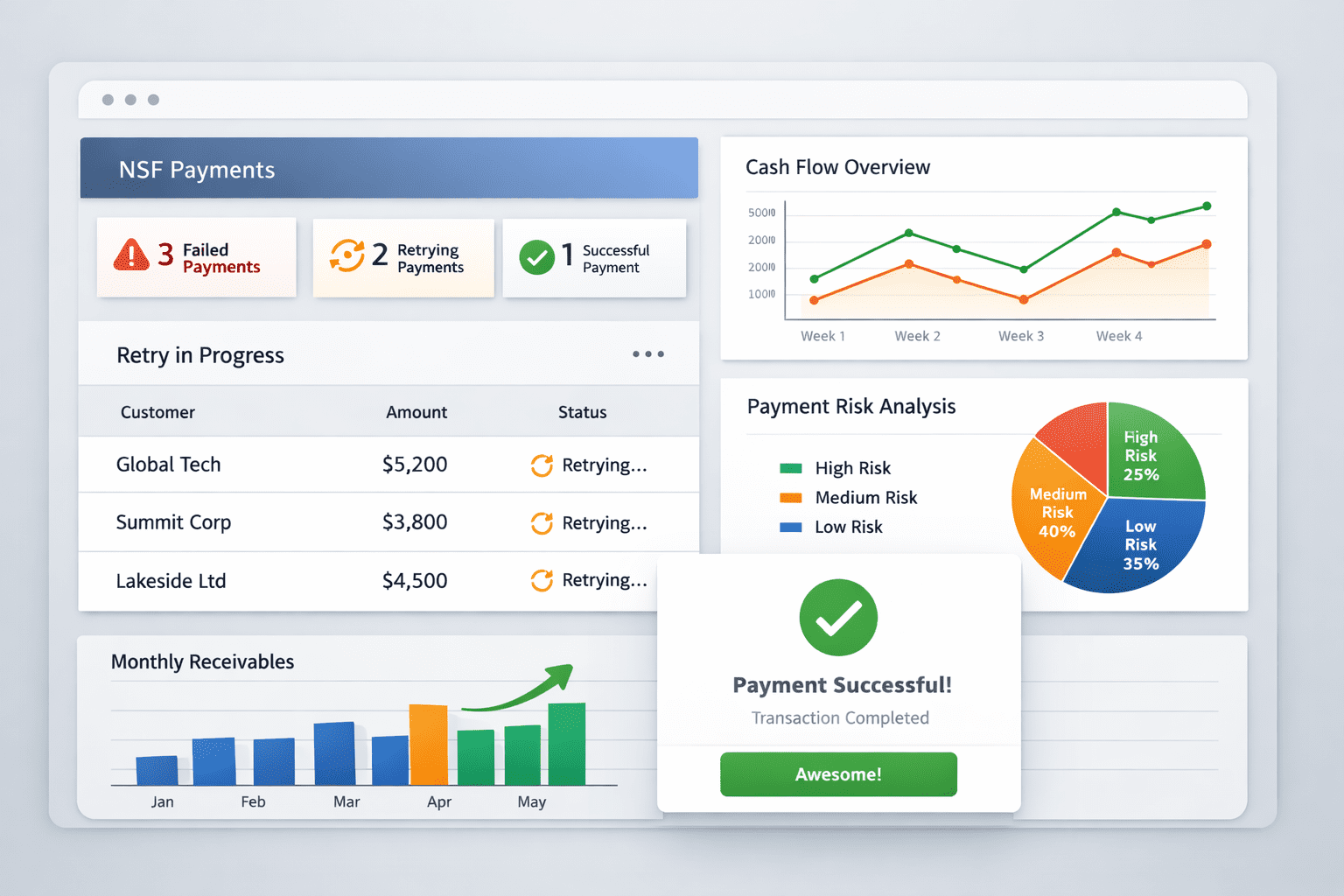

1. Real-Time Payment Tracking

Get instant alerts when payments fail.

2. Automated Reminders

Prompt customers to fund accounts before the due date.

3. Credit Risk Analysis

Identify high-risk accounts and adjust credit terms accordingly.

4. Retry Scheduling

Automate smart payment retries based on account balance patterns.

Proactivity beats reactivity every single time.

Bank Policies on NSF Transactions

Each bank has its own NSF policies — including fee structures, retry limits, and customer notifications. Some allow automatic re-presentment (retrying a failed payment once funds are available), while others require manual intervention.

Understanding your bank’s NSF handling rules helps you design smarter payment workflows and minimize downtime in collections.

Addressing Not Sufficient Funds Transactions Quickly

When an NSF occurs:

- Notify the customer immediately.

- Request alternative payment methods.

- Retry intelligently — not instantly — after checking fund availability.

- Document communication for transparency and future audits.

Automation tools can make this process smoother, faster, and more consistent across your receivables cycle.

The Role of Overdraft Protection in Preventing Not Sufficient Funds

Overdraft protection allows a bank to cover payments even when a customer’s account doesn’t have enough funds — essentially preventing an NSF rejection. However, this is a customer-side feature, and businesses can’t depend on it entirely. It helps reduce payment failures but doesn’t eliminate the need for proactive receivables management.

Benefits of Automating Not Sufficient Funds Management

Manually tracking NSF transactions is inefficient. With an automated system, you can:

- Get instant NSF alerts across all payment channels.

- Automate retries and follow-ups without manual intervention.

- Gain predictive insights on which customers might fail upcoming payments.

- Reduce DSO and improve liquidity visibility.

- Free up finance teams for higher-value tasks.

Automation transforms NSF handling from reactive cleanup to predictive cash management.

Conclusion: Stop Letting NSF Slow Your Business Down

NSF transactions may seem small, but their impact is big — delayed cash flow, frustrated customers, and wasted effort.

Modern finance teams can’t afford manual firefighting. They need real-time visibility, predictive analytics, and automation to ensure smooth collections.

About FinFloh

FinFloh helps businesses automate their receivables process — from invoice to cash — and manage NSF risks effectively.

With FinFloh Receivables Intelligence, you can:

- Detect and track NSF transactions automatically

- Get real-time payment alerts

- Automate retries and customer notifications

- Predict payment risks using behavior data

Keep your collections on track and your cash flow healthy.

Talk to an Expert or Request a Demo to see how FinFloh can help you eliminate manual NSF handling once and for all.