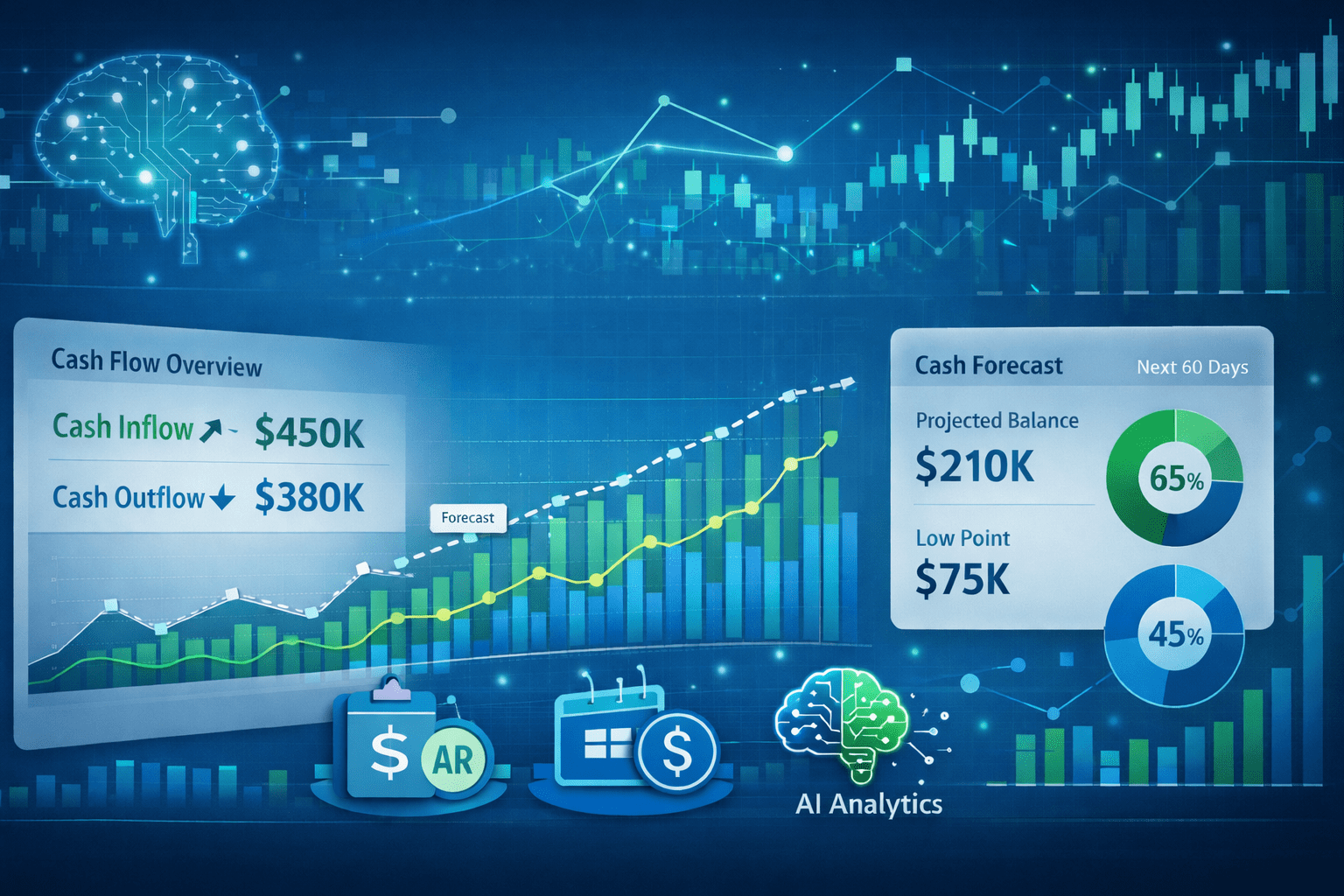

Short-term cash forecasting is a critical process that helps finance teams predict cash inflows and outflows over the next 30 to 90 days. This forecasting method ensures businesses maintain sufficient liquidity to meet their short-term obligations, optimize working capital, and navigate market uncertainties effectively.

Short-term cash forecasting steps in as a vital tool for financial control and agility. It’s not just about predicting numbers—it’s about empowering CFOs and treasury teams to make confident decisions about liquidity, working capital, and future investments.

Table of Contents

What is Short-Term Cash Forecasting and Why It Matters?

Short-term cash forecasting is the process of predicting cash inflows and outflows over a short horizon — typically 30 to 90 days.

Unlike long-term forecasts, which focus on strategy and capital planning, short-term forecasts are operational. They help answer real-time questions like:

- Can we meet payroll this month?

- Are we overextending on vendor payments?

- How much cash can we reinvest next quarter?

The goal is to ensure that a business has enough liquidity to meet its obligations while minimizing idle cash sitting in bank accounts.

How Short-Term Cash Forecasting Impacts Working Capital Management

Even the most profitable businesses can stumble due to poor cash visibility. In an environment where collections fluctuate and market volatility rises, accurate short-term forecasts help teams:

- Optimize working capital — Ensure receivables are collected on time and payables are managed strategically.

- Avoid liquidity surprises — Prevent shortfalls that could delay payments or harm vendor relationships.

- Support faster decisions — Give finance leaders a clear picture of where cash stands daily or weekly.

In 2026, cash forecasting is no longer an annual budgeting activity—it’s a continuous process.

Common Challenges in Short-Term Cash Flow Forecasting

The toughest part of forecasting cash flow? Predicting when customers will actually pay.

Accounts receivable (AR) represents the largest inflow for most organizations, but payment timing depends on customer behavior, not internal planning. Even when invoices are due, payments might be delayed due to:

- Customer cash constraints

- Miscommunication or disputes

- Inefficient invoice follow-ups

This is why many finance teams today integrate AI-powered AR management platforms — to improve visibility and forecast collections with precision.

How Short-Term Cash Forecasting Works

Short-term forecasting combines data aggregation, pattern analysis, and scenario modeling. Here’s what typically goes into building one:

1. Collecting cash inflow data

- Receivables (invoices, expected payments)

- Loan inflows, refunds, and other credits

2. Mapping out cash outflows

- Payroll, vendor payments, taxes, rent, debt servicing

3. Analyzing timing differences

- Matching expected collections with due obligations

Scenario planning

- Modeling best, worst, and expected cases based on historical payment behavior

Continuous updates

- Using real-time AR data and automation tools to adjust forecasts weekly

Leveraging AI and Automation

Traditional spreadsheets and manual reconciliation simply can’t keep up with the complexity of global businesses. That’s where automation changes the game.

Platforms like FinFloh leverage:

- AI models trained on historical collections data

- Invoice-level analytics that predict payment patterns

- Automated alerts for at-risk receivables

This combination doesn’t just enhance accuracy—it turns forecasting from a reactive task into a strategic advantage.

Finance teams can now simulate “what-if” scenarios instantly and make informed decisions like whether to draw on credit lines, delay non-critical spend, or accelerate collections efforts.

Best Practices for Accurate Short-Term Forecasts

- Start with clean AR data – Ensure invoices, due dates, and disputes are up-to-date.

- Involve cross-functional teams – Sales, operations, and procurement often hold insights into expected cash movements.

- Use rolling forecasts – Update weekly or biweekly to stay aligned with real-time realities.

- Leverage automation – Tools like FinFloh can auto-sync invoice data, payment trends, and reminders.

- Monitor KPIs – Track DSO (Days Sales Outstanding), forecast accuracy, and variance analysis regularly.

Conclusion: Turning Forecasting into Financial Foresight

Short-term cash forecasting is no longer just a treasury exercise—it’s a strategic foundation for every finance team aiming to stay ahead in 2026 and beyond.

With AI, automation, and connected AR intelligence, tools like FinFloh make forecasting faster, smarter, and more accurate—helping businesses not only survive uncertain times but thrive in them. Explore how FinFloh’s automation and cash intelligence can help you predict, plan, and perform better.